Thursday, January 1, 2009

Monday, December 29, 2008

Act right ... (on the radar)

Before we all go put on our 2009 party caps and tiaras, I'm looking into where I'm putting my chips into the coming 1st quarter. If you take a look back, both Nik and I were talking very doomsdayish when the global markets had a slight rally going into December (auto bailouts, global cookie cut financial stimulus', and schizophrenic investors.) Unfortunately my timing I believe was off, but my views have not changed much since. Obviously not a huge fan of retailers, commercial R.E and healthcare right now. The important thing is being able to spot which of these companies are the most vulnerable... right now. Commercial real estate has been anticipated to get hit as companies downsize, renegotiate for lower leases etc, and hell if you can't pay your credit cards and mortgage payments why the fuck would you pay the insanely expensive hospital bills? I got to look more closely at the healthcare sector as those companies have been hacked hard too.

Coming off such a drastic trading year, I'm looking to revise my watch lists as 2008 comes to an end. Keeping a steady eye on commercial real estate: SPG,JLL,CBG, hospitals: LPNT, CYH, and certain clothing brands like true religion jeans, abercrombie. I am still interested in where the hell the video game sector is headed too, I admit I was dead wrong with my short term sentiment on activision but they are better positioned then ERTS, TTWO imo.

Bare with us as my partner is on vacation enjoying Bali (you bastard! haha), I'll be less active with posts (until 2009) as we're prepping the final touches to BULLYBANK.COM, The world will get a better idea of just exactly what the F we're all about LOL! I hope you guys have a great NYE.

- cheers the hot revolver.

Friday, December 26, 2008

MERRY CHRISTMAS BULLIES! 2008 on the I V

We hope everyone had a great christmas regardless of the heavy grinch presence this year. I for one was just happy to beable to spend time with friends and fam and recap what a life changing calendar it has been. Who else basked in the glory of working on the 25th? haha nothing beats chauffeuring clients around to window shop property on xmas day! Anyhow, Merry Xmas and we are expected to launch www.bullybank.com come January 1st! A new year means new money! cheers - the hot revolver

Tuesday, December 23, 2008

Let's Talk About Quarter 1 of 2009

Things are looking bleak for the first quarter of next year. Today marked the fifth straight day of declines for the Dow Jones Industrial average, which historically rises 0.7% in the days leading up to the holidays. The release of horrible economic data in the past five days shows the economy plunging deeper in to recession.

GDP data released today showed a 0.5% contraction in the U.S. economy last quarter. Last quarter was relatively peaceful compared to the current quarter, which is a horrible sign because the real fall out of the financial crisis is being felt now. Some economists expect fourth quarter GDP to be as dismal as -6%. If it comes in that high, it's going to be a long time before our economy, along with the rest of the world, recovers.

Too add insult to injury we're now seeing modified mortgages default. This means that the lender has re-negotiated with the borrower to sweetened the terms of the loan, and the borrower still can't pay. This points us to further deterioration in the housing markets.

It's really simple, we're not going to see an economic recovery until housing prices stabilize and credit loosens up. The fact that we're seeing housing values drop at Depression rates is tough enough but add to that a credit freeze that still haunts financial markets, which ultimately affects businesses, and we're in for a very tought first quarter.

We've seen a lot of companies initiate mass layoffs this quarter and will see more jobs lost in the coming months. This means less spending in our economy and with tighter consumer credit standards people are going to be strapped for money. The big three are still not in the clear after their bailout, bond yields on GM and F debt still price in bankruptcy, which would mean a lot of jobs lost. Not to mention more government funds down the drain.

So, with all this this and a gloomy first quarter to look forward to, I see no reasons right now to buy stocks. I'm still going to be in sell mode until I see a stabilization in the housing markets. We might see a rally as the new administration gets sworn in but that won't last more than a couple days and will be an excellent opportunity to enter in to new short positions.

I bought Jan. 5 Puts on DRYS this morning as I feel the end is near with this company (no, I'm not obsessed!). The CEO seems to be up to his old shady tricks which lead his previous company to, yep you guess it, bankruptcy.

George Economou, the brilliant CEO of DryShips, owns a private company called Cardiff Marine. DRYS would buy ships from Cardiff all the time and entered in to contracts to buy more ships this year. Every time DRYS cancels a contract it pays Cardiff a cancellation fee. Care to guess whose pocket that fee goes too? Better yet, care to guess whose pocket the fee comes from? It seems as if Georgy thinks it's ok to rape the public company in order to fill his pockets.

Did I mention he's a billionaire who has already bankrupted one public company? It's amazing to be how much money has been pumped in to this stock (DRYS) and yet the writing is on the wall. It's merely a matter of time before the company defaults on a loan, or issues more equity further diluting common share holders, or their counter parties start to cancel contracts. Either way it doesn't look good and I definitely want to be positioned to profit off the event that causes this stock to tank.

The rest of this week should be pretty chill as Wall St. gets fully in to holiday mode (yea, no premium whiskey in the punch this year!) and, your boy Nik, takes a well deserved vacation to Bali! I'll be there until Jan. 3rd, 2009. I'll definitely be in touch with the markets but the focus is going to be on the three B's: beer, b*tches, and beaches...haha. Whaaaa??? I haven't taken a vacation in almost two years!!

-Nik

P.S. - The FULL SITE: WWW.BULLYBANK.COM COMING SOON!!!

GDP data released today showed a 0.5% contraction in the U.S. economy last quarter. Last quarter was relatively peaceful compared to the current quarter, which is a horrible sign because the real fall out of the financial crisis is being felt now. Some economists expect fourth quarter GDP to be as dismal as -6%. If it comes in that high, it's going to be a long time before our economy, along with the rest of the world, recovers.

Too add insult to injury we're now seeing modified mortgages default. This means that the lender has re-negotiated with the borrower to sweetened the terms of the loan, and the borrower still can't pay. This points us to further deterioration in the housing markets.

It's really simple, we're not going to see an economic recovery until housing prices stabilize and credit loosens up. The fact that we're seeing housing values drop at Depression rates is tough enough but add to that a credit freeze that still haunts financial markets, which ultimately affects businesses, and we're in for a very tought first quarter.

We've seen a lot of companies initiate mass layoffs this quarter and will see more jobs lost in the coming months. This means less spending in our economy and with tighter consumer credit standards people are going to be strapped for money. The big three are still not in the clear after their bailout, bond yields on GM and F debt still price in bankruptcy, which would mean a lot of jobs lost. Not to mention more government funds down the drain.

So, with all this this and a gloomy first quarter to look forward to, I see no reasons right now to buy stocks. I'm still going to be in sell mode until I see a stabilization in the housing markets. We might see a rally as the new administration gets sworn in but that won't last more than a couple days and will be an excellent opportunity to enter in to new short positions.

I bought Jan. 5 Puts on DRYS this morning as I feel the end is near with this company (no, I'm not obsessed!). The CEO seems to be up to his old shady tricks which lead his previous company to, yep you guess it, bankruptcy.

George Economou, the brilliant CEO of DryShips, owns a private company called Cardiff Marine. DRYS would buy ships from Cardiff all the time and entered in to contracts to buy more ships this year. Every time DRYS cancels a contract it pays Cardiff a cancellation fee. Care to guess whose pocket that fee goes too? Better yet, care to guess whose pocket the fee comes from? It seems as if Georgy thinks it's ok to rape the public company in order to fill his pockets.

Did I mention he's a billionaire who has already bankrupted one public company? It's amazing to be how much money has been pumped in to this stock (DRYS) and yet the writing is on the wall. It's merely a matter of time before the company defaults on a loan, or issues more equity further diluting common share holders, or their counter parties start to cancel contracts. Either way it doesn't look good and I definitely want to be positioned to profit off the event that causes this stock to tank.

The rest of this week should be pretty chill as Wall St. gets fully in to holiday mode (yea, no premium whiskey in the punch this year!) and, your boy Nik, takes a well deserved vacation to Bali! I'll be there until Jan. 3rd, 2009. I'll definitely be in touch with the markets but the focus is going to be on the three B's: beer, b*tches, and beaches...haha. Whaaaa??? I haven't taken a vacation in almost two years!!

-Nik

P.S. - The FULL SITE: WWW.BULLYBANK.COM COMING SOON!!!

Monday, December 22, 2008

a (my) new renaissance

Alright, apologies for such a depressing post earlier. Anyhoo, let's continue regardless of the losses, tomorrow's another day another opportunity! it's only habitual guys, the life of a bully!

I am still very impressed by how well the markets have moved and shown bear resilience the past few weeks. The argument again is whether or not the rally will continue into the new year despite all the negative factors. So are we bottomed out? have stocks dropped to levels that have already priced in all the bad news past,present and future? hard to call. But some obvious factors to keep an eye on are: Obama, post holiday retail results/forecasts, OIL, unemployment, real estate stabilization (and commercial r.e's near term forecast), renegotiation of corp. debts (most recently Macy's), tracking TARPs 2nd half and effects of the 1st(thus far), foreign macro, and global consumer micro! I know broad, broad issues but all very pertinent am I wrong?

The renegotiations between a company and their financier is CRUCIAL. Reforming leases, rates, payment schedules terms and so forth could help certain sectors experience turn around at a much faster pace. In a sense, the TARP and other bailouts should spawn extended hands to companies that deal with the original beneficiaries. Complex? fuck yeah, possible? of course. and I'm sure corp phone lines, conference rooms and contract drafters are VERY BUSY these days.

The scary part in all this is the following: All companies have and are in a probation period, and ONLY the strong SHOULD survive. There's little room for companies who have been breathing off the "spoof" side of the economy and in Jeffrey Gundlach's words the "bogadollars" (bogus dollars). I wouldn't want my money to be caught with the companies that will be filtered out in 09.

A new renaissance as I am going to call it, to bridge and fuse together the fundamental drive of capitalism with the new take on corporate responsibility. Gov, Wall street and Corp.s need leaders of the new school, remember these are the guys who pass the baton down to average investors, consumers, you and me. Does my article make sense now? I hope so. I'll be posting my personal stock picks tonight or tomorrow but I want to leave you with this image. To address the $50+ Billion Madoff Scandal and to the new renaissance...don't get played like a harp playa(z)! cheers - J the hot revolver. ***OFFICIAL WEBSITE BULLYBANK.COM COING SOON!***

I am still very impressed by how well the markets have moved and shown bear resilience the past few weeks. The argument again is whether or not the rally will continue into the new year despite all the negative factors. So are we bottomed out? have stocks dropped to levels that have already priced in all the bad news past,present and future? hard to call. But some obvious factors to keep an eye on are: Obama, post holiday retail results/forecasts, OIL, unemployment, real estate stabilization (and commercial r.e's near term forecast), renegotiation of corp. debts (most recently Macy's), tracking TARPs 2nd half and effects of the 1st(thus far), foreign macro, and global consumer micro! I know broad, broad issues but all very pertinent am I wrong?

The renegotiations between a company and their financier is CRUCIAL. Reforming leases, rates, payment schedules terms and so forth could help certain sectors experience turn around at a much faster pace. In a sense, the TARP and other bailouts should spawn extended hands to companies that deal with the original beneficiaries. Complex? fuck yeah, possible? of course. and I'm sure corp phone lines, conference rooms and contract drafters are VERY BUSY these days.

The scary part in all this is the following: All companies have and are in a probation period, and ONLY the strong SHOULD survive. There's little room for companies who have been breathing off the "spoof" side of the economy and in Jeffrey Gundlach's words the "bogadollars" (bogus dollars). I wouldn't want my money to be caught with the companies that will be filtered out in 09.

A new renaissance as I am going to call it, to bridge and fuse together the fundamental drive of capitalism with the new take on corporate responsibility. Gov, Wall street and Corp.s need leaders of the new school, remember these are the guys who pass the baton down to average investors, consumers, you and me. Does my article make sense now? I hope so. I'll be posting my personal stock picks tonight or tomorrow but I want to leave you with this image. To address the $50+ Billion Madoff Scandal and to the new renaissance...don't get played like a harp playa(z)! cheers - J the hot revolver. ***OFFICIAL WEBSITE BULLYBANK.COM COING SOON!***

Friday, December 19, 2008

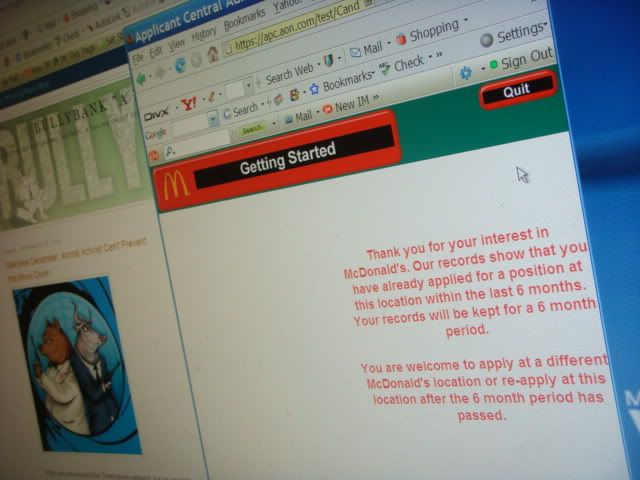

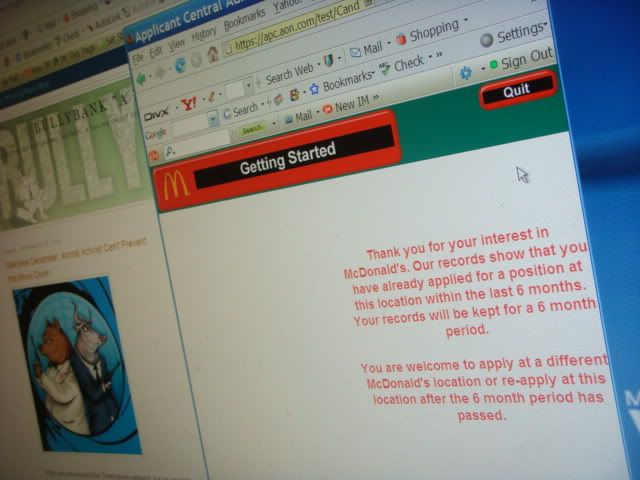

back to square 1 ( -99.9% portfolio value) applied for McDonalds

*the day has come, options expire, portfolio annihilated,

*Literally applied for and rejected by Mcdonalds. (click below for full pic)

exactly 600 transactions in 2008 involving the following co.s: LDK,TSL,AOB,STV,VRTX,WFC,ENOC,CROX,ZLC,SBUX,TASR,YHOO,CSIQ,JASO,SOL,WM,WB,UBS,AIG,CC,SNDK,CC,CBG VZ,ANF,ATVI,EFUT,BX,FFCH,MVIS,LQDT,PALM,TZOO,DESC,XRTX,CHL,EDU,STP,LQDT,SSRX,XING... to add insult to injury, the escrow on my client's deal is dead as of yesterday evening, due to the loan not being approved..smh..life of the self employed is rough sometimes haha. *PLEASE proceed to reading the great article about APPLE my partner has written* - cheers the hot revolver

As we come to the close of 2 0 0 8, I push the button...a new year, a new start.

*Literally applied for and rejected by Mcdonalds. (click below for full pic)

exactly 600 transactions in 2008 involving the following co.s: LDK,TSL,AOB,STV,VRTX,WFC,ENOC,CROX,ZLC,SBUX,TASR,YHOO,CSIQ,JASO,SOL,WM,WB,UBS,AIG,CC,SNDK,CC,CBG VZ,ANF,ATVI,EFUT,BX,FFCH,MVIS,LQDT,PALM,TZOO,DESC,XRTX,CHL,EDU,STP,LQDT,SSRX,XING... to add insult to injury, the escrow on my client's deal is dead as of yesterday evening, due to the loan not being approved..smh..life of the self employed is rough sometimes haha. *PLEASE proceed to reading the great article about APPLE my partner has written* - cheers the hot revolver

As we come to the close of 2 0 0 8, I push the button...a new year, a new start.

Subscribe to:

Posts (Atom)